Bitcoin: the internet’s enigmatic alternative to conventional currencies

More and more articles are written every day about the risks of Bitcoin and the imminent crash of the obvious bubble, but people are still buying in by the billions, as other individuals cash out for hundreds of millions. Is it too late, or is Bitcoin just getting started? A good understanding of what cryptocurrencies are can inform and empower anyone to choose for themselves whether or not to get involved, whether it's too late, or if it's just not going to last.

Only a couple of weeks ago, I read an article online that was explaining how the recent rise in value of a single Bitcoin up to $10,000 lacked substance, and a pullback was inevitable. A pullback involves the price of a stock or currency decreasing from a peak, signalling a pause in upward momentum. This happens as a huge surge in new buyers of Bitcoin artificially inflates its value, and instead only represents a surge in popularity, and not necessarily an increase in the coins intended usage. The article concluded that a pullback to well below the $10k mark was inevitable, and a rise of another thousand up to $11k was very unlikely. After I closed the article, I checked on the price to see which way it had shifted after hitting the long awaited $10k mark, only to see that it was already sailing past $11,500, just a couple of hours after the article was published. In the days since then, the ups and very few downs of Bitcoin have been a rollercoaster ride that’s brought thousands of new cryptocurrency pioneers, interested technology fans, hopeful investors and even a few optimistic technophobes into the fold. The price has soared to $20,000 per Bitcoin, dipped back down to $15k and risen again. The volatility increases as the price continues its explosive upward overall trend. You’ve probably heard a lot of different ideas about Bitcoin, cryptocurrencies, or blockchain by now and if you’re like most, you likely have no idea what the big deal is, or why it’s suddenly worth so much?Cryptocurrencies: Magic internet money?

Bitcoin is the first example of a cryptocurrency, which is a type of digital or virtual currency. The point and application of a virtual currency is to not be reliant upon centralised banks and historically typical financial systems for support. Cryptocurrencies were not designed to be watched as they rise and fall in value and provide a pay-out to long term investments like a commodity, but to be a replacement for the currency used to trade goods and services. The idea of cryptocurrencies does face some criticism, as it may become a popular choice for criminals, due to the relative anonymity of paying via cryptocurrencies. Sites like The Silk Road that have been shut down because they would accept Bitcoin as a payment method for the illegal goods and services that they offered, with over 26,000 Bitcoin being seized by the FBI. Cryptocurrencies can also be slower to be processed than typical payment methods like credit cards, but there is no risk of fraud or of chargebacks being made months later on. The volatility of the world’s leading cryptocurrency, Bitcoin, is both its greatest strength and its greatest weakness. It is the source of its popularity and of its antipathy. Bitcoin is not yet held to the same standard as gold or even established currencies, principally due to its relative infancy. Traders will make money in established markets by understanding the components that influence prices and how some factors effect and knock on the price of commodities, stocks and currencies. This is a lot harder to do with Bitcoin as factors that can have an influence on its price are wildly varying and not yet well defined. Countries, like China for example, creating obstacles for cryptocurrencies can have a negative effect, but the policies of other countries, companies, exchanges or investment funds showing an active or even passive interest can often bolster the price. Most recently, it has been the media attention surrounding the cost of one Bitcoin rising to $10k that has driven many people to look into acquiring their first few coins and has continued to drive the price upwards.Value and investment

People do wonder how and why, what is deemed jokingly as an imaginary form of internet money, has come to become worth so much. A lot of the answers to questions like that come from an understanding of the underlying technology, how it is different and the improvements it makes when compared to modern financial systems. Fundamentally, the actual value assigned to a cryptocurrency is no different than the value assigned to a regular paper currency or commodity like gold. The main difference is to do with the backing. A national currency will be backed by that countries government, be well established and understood by all citizens, whereas a nationless internet based coin is backed by those who have faith in it as a currency, and may have somewhat shaky faith in modern, long withstanding banking institutions. A lot of these older institutions, businesses and even entire industries have suffered and new ones have prospered as more of the world's commerce and interactions take place online. With the development of the internet, the rate at which online businesses and services have evolved has dwarfed all other comparable examples of technological progress. The most popular methods of commerce, content delivery and production have been overhauled by the rise of the internet, so it should not be such a surprise to see currencies themselves undergoing the same revolution. Value in Bitcoin comes from faith in Bitcoin, whether it may be the faith from an understanding of the technology or a desire to invest in coins predicted to rise in value. The worth of a coin relies upon the understanding and agreement regarding common currencies, just as paper money is just paper without context and compliance. [bitcoin-chart]Candlestick graphs are used to show the highs and lows of Bitcoin as well as the opening and closing prices.

Most discussions at the moment revolve around how much money you can make by investing in Bitcoin. The answer is a lot of money. Recently the Winklevoss twins made headlines again by becoming the first Bitcoin made billionaires, as the price of a Bitcoin hit $11,500 and the $11million of the $65million pay-out they received from their Facebook lawsuit that they invested into Bitcoin turned into a ten digit number. Although most people won’t be buying millions of dollars worth of Bitcoin, some who have previously been early adopters are now millionaires as a result of the decision to take a risk early on. The early adopters and the relatively late coming millionaires remain alike because of their understanding and confidence in the underlying platform and technology. Before anyone should consider buying Bitcoin, they should possess a reasonable understanding of the technology and why it is expected to go from strength to strength. It is important to also look at the risks, the long and short-term challenges and even potential alternative cryptocurrencies to Bitcoin. This is important as everyone should be aware of all the information before investing or spending considerable amounts of money, but also because it is the success or failure of the idea and the technology that in the end determines how the value of a particular cryptocurrency changes. Therefore, the best answer to “should I be buying Bitcoin?” is the one that someone arrives at themselves, based on what they understand about it. [signup-form]Intended usage

Bitcoin was designed to be a uniquely secure and decentralised currency that cannot be meaningfully influenced or controlled by any institution or individual person. This has been achieved to some degree, with only theories about holders of large amounts of coin sometimes influencing the market. There exist a lot of ideas about mysterious people or groups who own a disproportionate amount of coin, so have huge leverage and control over the price of Bitcoin. Issues do plague the currency as a practical payment method for everyday transactions, with slowing transactions and increased fees as it scales upwards being the biggest issues that the network faces. The technical development of Bitcoin continues to try and overcome these obstacles, with some solutions being planned for release next year, and some hard forks claiming to be the solution to the problems. But whether Bitcoin blossoms into a truly practical decentralised currency or not, it has established itself as the core unit of online currency, often to which other cryptocurrencies are measured and traded against. A new coin on an exchange may have price with respect to USD, GBP or EUR, but the price will also be tracked in comparison to to BTC.Who runs Bitcoin?

One of the most important differentiating factors regarding cryptocurrencies is decentralisation, meaning that there is no central authority issuing and controlling supply. The code behind Bitcoin is available in full on Github and is contributed to by over 480 different people, and anyone can go and make a change (which may not get approved by the community) that will end up in the main code used by everyone trading in Bitcoin worldwide. The technological direction and what updates are introduced is driven completely by the wide community of developers, miners, users, traders and investors. In time, other factors may begin to have some influence on Bitcoin. Factors such as government policies, technological advancements or the even the mass adoption of the currency by users could alter the requirements and direction significantly as obstacles are introduced. But one of the defining principles remains the decentralisation of control and non-reliance upon national and private banking institutions. There is no need to trust in a bank or another individual where cryptocurrencies are concerned. With a basic understanding of how to use Bitcoin, the cold, mathematical, rule-based structure that governs the system completely removes any requirement to trust people.The original creator

There is of course an original creator of Bitcoin technology; Satoshi Nakamoto. Satoshi’s identity, or possibly the group identifying as the individual has never been revealed publicly, and only speculation exists. These range from old forum profiles suggesting a Japanese man in his 40’s, to someone of British origin (due to some of the colloquialisms in his initial code comments), to a North American, based on analysis of the times of day that that code was most frequently committed. The smallest possible denomination of Bitcoin is 0.00000001 (a one millionth) was named a Satoshi in honour of the technologies founder. The original whitepaper titled ‘Bitcoin: A Peer-to-Peer Electronic Cash System’ was published in October of 2008 with the first Bitcoin software being released the following January. The following year, Nakamoto handed control over the Bitcoin sites, core code all responsibility over to the community of developers who had been contributing up to that point, and ceased all involvement. Nakamoto’s own initial Bitcoin addresses show him as owning roughly one million coins, all unspent so far, totalling over fifteen billion dollars in today’s market and making him (presuming it is one person) among the top 100 richest people in the world and well on track to become the worlds first trillionaire.Decentralisation and blockchain

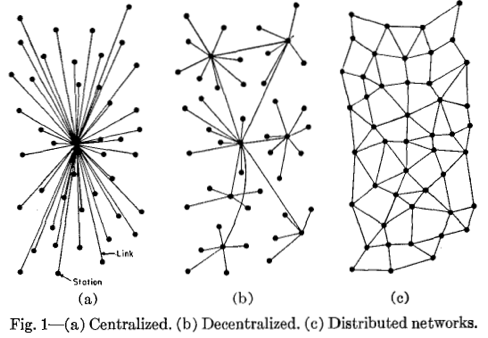

The real difference and reason behind why any of this is different or important relies upon an appreciation of the underlying technology that powers cryptocurrencies. In Nakamoto’s original paper, Bitcoin is only an example application of a technological concept termed ‘Blockchain’. Bitcoin was only really ever built as a proof of the concept. The important part about this concept is its possibility to progress as a decentralised technology, but decentralised is not an easily defined term. [caption id="attachment_8507" align="aligncenter" width="488"] Source: https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274[/caption]

[third-blocks]

Source: https://medium.com/@VitalikButerin/the-meaning-of-decentralization-a0c92b76a274[/caption]

[third-blocks]

A decentralised network

Blockchain technology is inherently decentralised, as all of the computers (nodes) in the network are still required to validate, spread user transactions around the network and confirm blocks into the blockchain. A blockchain can be thought of as a ledger that contains a record of all activities relating to the purpose of the blockchain. An activity in this context is the sending of money or information from one place to another. Every group of activities added is another block, added as a new entry in the ledger; the chain. An exact copy of that ledger is stored across all computers and devices in the network, providing security and decentralisation. When anyone attempts to push something new to the chain, such as a cryptocurrency transaction, all available connected nodes receive the request and attempt to validate it, share it and eventually add it to the end of the chain. This keeps a permeant and unalterable record of all transactions that have ever taken place, that is available to everyone. Common usage of (de)centralisation actually refers to architectural (de)centralisation, which is the measure of a networks capacity to tolerate breakages of multiple individual computers at a time. Blockchains are all typically architecturally decentralised in that no one specific node is relied upon more than any other, allowing the network to still function with a large number of outages. Political (de)centralisation refers to how many individuals or organisations are in control of the computers that make up the network. Blockchains are also mostly politically decentralised in that there is no single individual responsible for control. The code and project are open source and anyone is able to get involved and help drive the direction of the project. Logical (de)centralisation refers to the interface and data structures of the network, specifically whether or not computers in the system are set up as a specific single entity, or a great amorphous swarm. A test of logical centralisation is whether or not parts of the system can continue to operate completely if it is cut up into halves or quarters.What actually is a Bitcoin?

A cryptocurrency like a Bitcoin does not actually exist anywhere in any form, physically or even electronically. There is no single item or piece of code that directly denotes the presence of a Bitcoin, there is only a list of locations (addresses) and amounts. If you own a Bitcoin, then all that means is that at the time which you came to own it, an entry was added to the blockchain that said, “send a value of 1 Bitcoin to this address”. Your ownership of your coins is not reliant upon your name, your date of birth or even your ID, but by your ability to access the private contents of a unique Bitcoin address.Wallets and addresses

To begin sending or receiving cryptocurrencies, a digital wallet is required. A wallet will hold and create address, which are strings of between 26 and 36 alphanumeric characters. Each new address is completely unique and is the identifier recorded in the blockchain that determines the location of all coins in existence. Even when coins are newly created, there will still be an address to which they are immediately assigned, usually owned by the person doing the mining on their computer. When a new address is generated within a wallet, private and public keys are created. The public key is used to generate the actual characters of the address using a hashing algorithm. The public address will allow other people to find and send coins to that address, not unlike bank account information that would be given out for others to transfer money to. The difference is that anyone can look up a public address and determine the amount of Bitcoin at that address, as the complete history of all transactions is in the blockchain and visible to anyone. Addresses are randomly generated, but the amount of possible different addresses renders the likelihood of a duplicate address almost statistically impossible.Because of the way wallets work, it is possible to purchase hardware wallets, which are similar to USB drives with specific security code and protection measures in place. This adds a security risk by moving access to Bitcoin to a physical device, but reduces the risk of using an exchange that can be hacked or a computer that can break down.There are 1461501637330902918203684832716283019655932542976 possible different Bitcoin addresses.

Transaction signing and verification

The private key of each address, which is stored in the wallet data file, is used to digitally sign any requests made to transfer coins. Any computer within the network running the right code can receive a request that has been digitally signed by a private key and use the public address to verify that the transaction is legitimate. Complex mathematical algorithms (specifically the elliptic curve digital signature algorithm) are used to digitally sign transactions, making forgery virtually impossible. Digital signatures act as a way to verify that transactions coming from a public address were signed by a private key, without actually having to see the private key. When an amount of Bitcoin is sent from one person to another (one address to another), the wallet used to initially send the transaction will validate the request. Validation involves the request passing all of the basic rules, such as correct formatting and available balance. Available balance at an address is found only by looking at entries into the blockchain that record coins arriving at or leaving that address. Records of coins arriving at an address is known as the inputs and records of coins leaving are known as outputs. The total history of inputs and outputs dictate an effective balance, not unlike a conventional bank account. Because every node on the network has a complete independently verifiable record of all transactions, before confirming that an amount of Bitcoin can be sent from an address, all transactions of coin into that address can be checked to ensure that they have not been sent elsewhere previously. Every single computer on the network that this transaction passes through carries out its own, completely independent verification checks in this manner. However, checking through over 20 million previous transactions (to date) can be very time consuming, so there is also a special index of input transactions that have not been used as outputs in other transactions, and are therefore still currently at a particular address. Once the transaction has been verified, it is signed with the wallets private key and broadcasted by the sender to all the local nodes, which perform their own validation checks. If the validation checks are not passed, then that node will drop the transaction, and it will not propagate further through the network. If the checks are passed, the node will pass the transaction around to other nodes it is connected to for them to validate too. In this way, non-valid transactions are very quickly rooted out and do not spread very far within the network.Node corruption

If one node is corrupted, running out of date code or set up to act maliciously, then there would still be sufficient enough other legitimate nodes to effectively ignore its output and continue the transactions propagation around the network. If a lot of nodes produce an inconsistent or corrupted transaction, then that transaction will quickly be abandoned as it will not propagate through the network and will not be permanently committed to the blockchain. This is the real power of a completely distributed network.What is mining Bitcoin?

The idea of a node has been fairly important so far, but not yet fully explained. Any computer or device in the network is an example of a node. A full node will include around 140GB of transaction history data. This ties directly into another term that most people have heard about; Bitcoin mining. Mining just a nickname given to the process of adding transactions to the Bitcoin blockchain. Some people mine using their home PC, some buy warehouses full of mining rigs. These are comprised mostly of graphics cards, which are more efficient to mine with than processors. There are even specialised chips that are built solely for the purpose of mining Bitcoin blocks as efficiently as possible, and nothing else. These are called ASIC chips, or application-specific integrated circuit chips. A concern as of late has been the cost and impact of the high electrical requirements of Bitcoin mining computers / cluster set-ups. Those with large clusters of mining computers will look at the huge power requirements and bills vs the output from Bitcoin mining and ensure that they are making a profit. For the time being, most over a certain size are still making a huge profit.Mining blocks

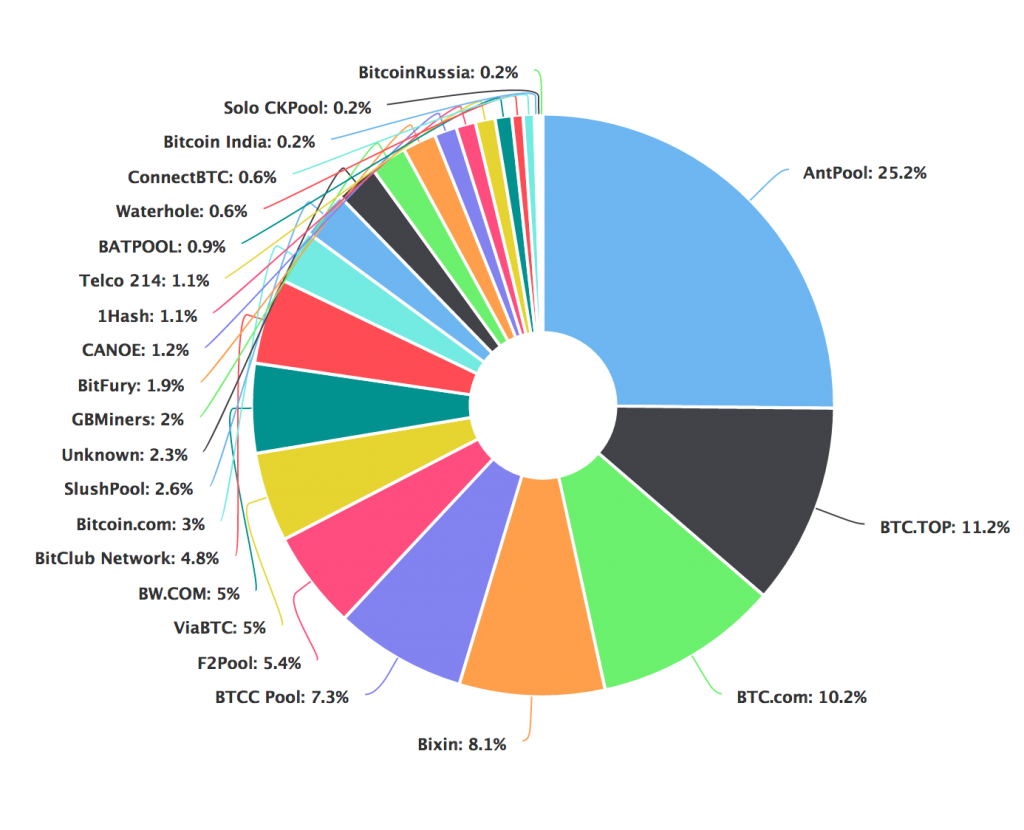

Mining is actually a core component of the Bitcoin network and technology, and has multiple essential purposes. As explained above, a request gets verified and passed around the network relatively quickly. Although all these nodes are passing it around (or dropping it if it is corrupted), none of them are actually committing it to the blockchain as of yet. This is because if they did, there would be a problem regarding timing, as two nodes could submit the same request to output coins from one address, and both could commit to the blockchain at the same / similar times. This would eventually result in an error, and for a retailer who is sending out products, this may result in them never receiving the coins they were to be paid. This is solved when transactions are bundled into blocks and sent to mining machines to be solved. Any node can collect a set of unconfirmed transactions into a block and broadcast it to the rest of the network as a suggestion for what the next block in the chain should be. All transactions in the same block are considered to be made at the same time, and those not yet in a block are considered unconfirmed. Like transaction histories are used to determine ownership, coin availability (balance) and inputs / outputs, the block-chain a is used keep and track the order of transactions, with each block referencing the previous. A block of transactions must be solved, which involves a very long and difficult mathematical process and a lot of random luck. The randomness of it means that every mining node in the world is competing to get the right answer, so that they can add the block that they have selected to the blockchain and get rewarded for being the first with newly created Bitcoins. Mining is decentralised in that it happens individually on different machines. Machines can be grouped together, but each one must still perform its own tasks. Miners can even pool together into group efforts to solve blocks. A user mining on their own will receive the transaction fees paid by users to run their transactions, but they will not see the whole coin rewards from solving and confirming blocks unless they are incredibly lucky and solve the block first on their own. The advantage of a mining pool is that if that pool of users collectively solves a block, then the coin rewards are distributed among the pool users, based on the effort they put in. Effort here would be measured by the number of attempts at finding a solve, which is basically the number of computers or computing power that user has contributed to the pool. Some pools are organised to distribute rewards slightly differently, with some keeping transaction fees but distributing mined block rewards. Some mining pools are responsible for huge portions of blockchain block solves, with the top 8 pools being based in China. Countries with cheaper electricity prices also tend to form large mining pools, as power costs have the biggest impact on profit margins. [caption id="attachment_8516" align="aligncenter" width="900"] The top mining pools and the percentage of the network they are responsible for. Source: https://www.buybitcoinworldwide.com[/caption]

The top mining pools and the percentage of the network they are responsible for. Source: https://www.buybitcoinworldwide.com[/caption]

SHA-256

Mining machines receive a block and must solve it in order to be allowed to add it to the blockchain. Every mining node picks one of the suggested local blocks of transactions and begins to attempt to solve it. Solving the block involves resolving a mathematical equation using an SHA256 cryptographic hash. This hashing algorithm is not a code, but a way to translate text into a 32byte string of characters, most commonly used to storing passwords online. When a password is entered into a form online for the first time (like when signing up as a user to a new site), it is hashed, and the result is stored in the database. Because the hashed result is impossible to reverse, it’s impossible to ever get the original password. Then when a user returns and enters their password, it is hashed and checked in the database to see if it matches the stored hashed value, and a user is granted entry if it does. It is the inability to reverse the process and determine original text from the hashed value (without trying every single possible password) that adds security. SHA2-56, originally developed by the American National Security Agency, is an unbroken encryption method that will unlikely be broken by brute force for decades or even centuries to come, depending on the rate at which quantum computing evolves.Solving hashes and confirming blocks

Solving the mathematical problem is not a case of figuring something out and performing calculations, it is more a case of random dice rolling, trying to slowly and somewhat randomly find a valid solution. It’s relatively easy to create a SHA256 encrypted string, so how is this related to solving blocks in Bitcoin mining? Well, there are extra requirements to make things more difficult. The mining machine takes the text from the block and adds a random 4byte string of characters to the end before hashing it. This 4byte string of characters is known as a nonce (number used once). Changing a single character in the nonce, or any part of the text that is to be hashed will produce a completely different output string. At this point, the hashed output cannot be predicted due to the complexity of the SHA256 algorithm. If the resulting text starts with a certain number (x) of zeros, then it is considered solved and the nonce is known as a “golden nonce”. The chances of finding a golden nonce are extremely unlikely and completely unpredictable. This adds a degree of randomness and complexity. [sha-converter] The value of x is updated every 2016 blocks (roughly every two weeks) depending on how quickly blocks are being solved. The aim is to keep the time it takes for all mining nodes worldwide to find a solution at around ten minutes. If blocks are being solved faster than one every ten minutes, extra zeros (n) will be added to x (x+n), meaning that it’s even more unlikely that a random nonce will produce a SHA output containing that many zeros. If blocks are taking too long to be resolved, the number of zeros required at the beginning will be decreased (x-n). The defining feature of some other coins, specifically Litecoin is that the time to solve (tts) is kept at around 2.5 minutes, significantly increasing the speed at which transactions are processed. Although that sounds immediately advantageous, were Litecoin operating at the scale that Bitcoin is, a profusion of issues may arise around the network's capacity to keep up with blockchain updates. Once a block is solved, the mining node begins sending it around to connected nodes. Because hashing is a quick process to do once, all other nodes can quickly verify that the blocks text content along with the nonce on the end resolves via SHA256 to a value with a sufficient number of leading zeros. Nonces can never be re-used because the text that precedes the nonce is still a part of the text to be hashed, so is different for every block, meaning that a nonce will never work for multiple blocks. Solving blocks like this removes the problem of ordering that would arise from a transaction only history. Because only one block will be added at a time, no two transactions attempting to use the same available Bitcoin at an address will ever join the blockchain (unless there is sufficient coin there for both transactions). If two blocks are solved at very similar times, and both begin propagating through the network, then nodes will remain divided in two until the next block is solved. The side that solves the next block first will have their chain become the accepted master by all others. The transactions from previously “solved” blocks on the losing side will return to the pool to be regrouped into blocks and re-solved. Although a valid transaction that is sent out into the network is pretty permeant and irreversible, it is not uncommon to wait the up to ten minutes for the next block to be solved so that the transaction can be confirmed. For much larger transactions, some services advise waiting around an hour for as many as 6 confirmations, as the older a transaction becomes, the more secure it is as far more blocks would have to be orphaned and rewritten.Find X such that f(block+X) < t(cryptographic hash)

Incentives

The lucky computer or cluster of computers that come up with the solution first will earn themselves an amount of Bitcoin as a reward for being first. This is the incentive that people have to “mine” Bitcoin and spend money to run mining nodes. The actual “mining” is just the possible reward available. Part of the reason that this works is the fact that it is so unlikely that a computer will resolve a block, that all computers in the world that are attempting to will only solve one every ten minutes or so. Statistically, it would take an individual home computer years of constant running to have a reasonable chance of being the first to make a resolution. To incentivise individuals to contribute to some degree, miners pool their resources into groups that are all working together to check as many nonces as possible. If the pool solves a block, the reward is distributed to all those in the pool based upon how much they each contributed (how many nonces each computer tried). So someone running one computer would expect to receive half as much in reward as someone running two of the same computers, in the same mining pool, if that pool solved a block. The Bitcoin block mining reward halves every 210,000 blocks. This is to maintain a controlled supply as the limited supply of Bitcoin becomes more and more mined. There are 132,574 out of the 210,00 blocks left currently until the reward halves again from 12.5 to 6.25 coins, which is expected to happen in June 2020. There will only ever be 21 million Bitcoin, with just over 16.7 million (79.61%) mined and in circulation currently. As well as the rewards for solving a block, or being part of a pool that solves a block, Bitcoin transactions can include optional small fees that are paid to miners when blocks containing those transactions are solved by that miner/mining pool. This adds further incentive and means that incentive remains once all Bitcoin have been mined. The increase in worth has outpaced the decrease in reward amount over time, but when this slows, it is expected that small transaction fees will become more commonplace. [half-countdown]Time until the next coin reward drop from 12.5 to 6.25 BTC

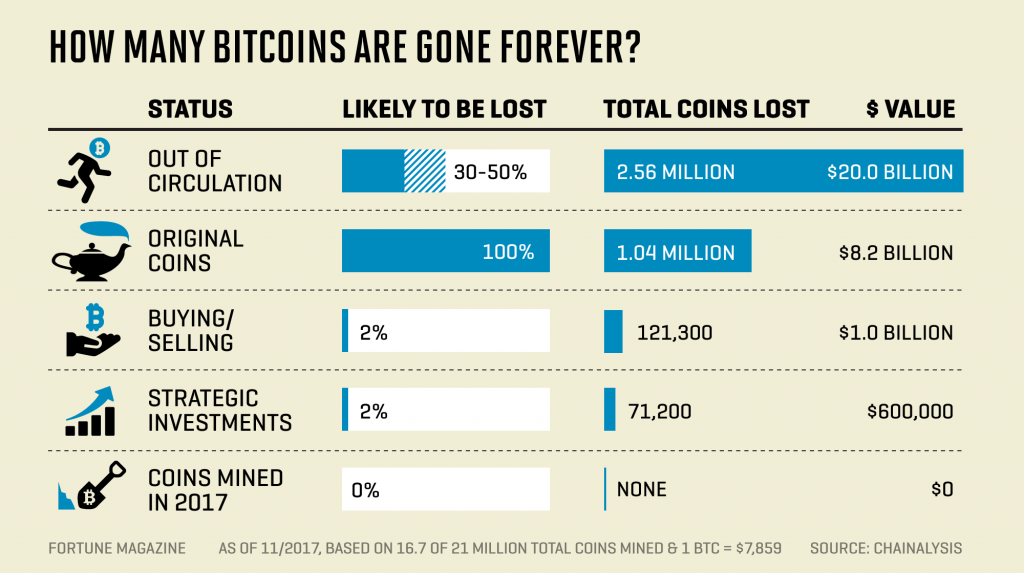

Lost coins

Bitcoin is sometimes referred to as a deflationary currency, which can mean several things. A typical deflationary currency is so because the general price level is falling due to an increase in productivity. This is not exactly the case for Bitcoin, but it is similar in that the demand for Bitcoin is going up, giving effectively the same result. This is a deflationary pattern instead of an inflationary one because it is the value of goods with respect to the coin that are going down, not the value of the coins themselves, which continue to increase. The second definition of deflationary is regarding a shrinking supply in the currency. This is a long-term concern for some, as although currently far more coins are mined daily (over 1800 a day) than are lost (impossible to know), there will always be ways to lose coins forever, whereas the current plans dictate that Bitcoin can and will eventually be “mined out”. Coins can be lost when they are sent to incorrect, unowned addresses that will never realistically be recovered. They can also be lost as people lose where they have address keys written down, be that on hard drives that suffer failures, documents that get deleted or one of a myriad of possible computer problems that prevent the recovery of address details. Investments also have the potential to contribute to a deflationary spiral that could theoretically eventually crash entire coin currencies because people over-invest and hold coins without using them, making the currency less and less practical for the intended use. All the while the currency’s value would be increasing up until a crashing point where all value is lost.Smart contracts and solving

Some transactions that are confirmed and added to the blockchain require further conditions in order for users to be able to retrieve coins. While most transactions and can only be retrieved by the owner of a particular public key (the person receiving the coins), this is not limited to a single receiving user, and fully solving a transaction to retrieve the coins can be programmed to require multiple particular signatures to resolve and claim, or require certain conditions to be met. This can be useful for escrow arrangements. It is also possible to code specific conditions that must be met to solve the transaction and receive the coins within. This includes the possibility for no conditions at all, as was the case with the first ever Bitcoin transaction for 50 coins, which was available to be solved by anyone. Conditions like this are a prime example of a great use-case for Blockchain technology, as definable, computable criteria must be met in order for funds to be released. This is a contact that can never cause legal issues, as once agreed upon, the releasing of funds is both completely automated within the system and absolutely unstoppable, as there is no central authority in the network to do so. Creating smart contracts without advanced knowledge of doing so can be very risky, as the code must be flawless to avoid error. Sending Bitcoin to an address with even one incorrect character will result in it being irretrievably lost forever. Freedom from centralised banks has its advantages, but does not afford some of the user error comforts that some have grown to rely on. Bitcoin fully supports smart contracts, but another cryptocurrency was created with just this application in mind from the start. Ethereum is the cryptocurrency with the second largest market cap behind Bitcoin, and is incredibly popular due to its brilliant technical design. [caption id="attachment_8520" align="aligncenter" width="900"] Source: https://fortune.com/2017/11/25/lost-bitcoins/[/caption]

Source: https://fortune.com/2017/11/25/lost-bitcoins/[/caption]

Alternative cryptocurrencies

Bitcoin is the original application of Blockchain technology, but there are many others nowadays, most designed around a specific application or role. Alternative coins, or “altcoins” (alternatives to Bitcoin) are launched by individuals, tech start-ups, established companies or anyone with the technical knowledge, financial backing and available development resources to get such a project off the ground. The most popular altcoins attempt to target a particular problem that Bitcoin does not solve at the moment, or a problem that the rise in Bitcoins popularity has created.Ethereum

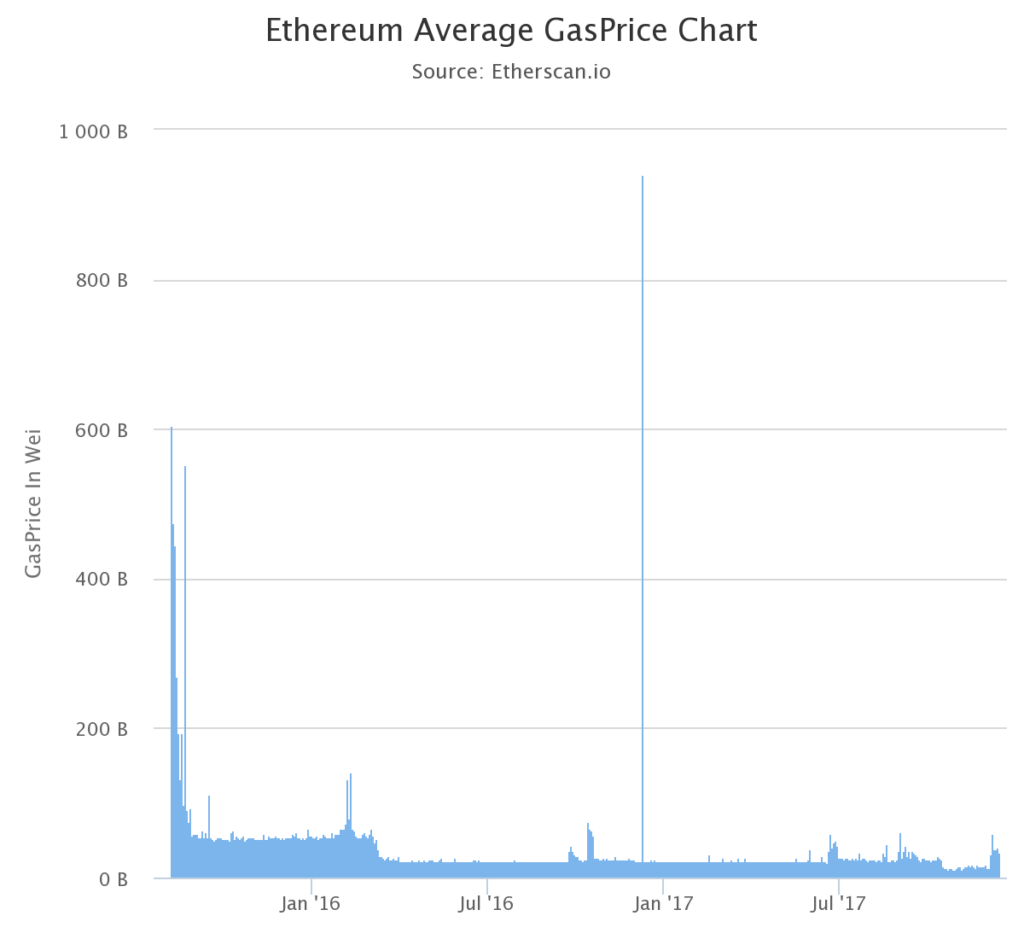

Without a doubt, the second largest coin after Bitcoin is Ethereum. Ethereum is a coin designed to take the idea of smart contracts, something that is doable to an extent with Bitcoin, to a new level. Using Ethereum coins as a currency, Ethereum blockchain technology allows anyone to create very particular smart contracts without any possibility of downtime or censorship. Ethereum differs from other altcoins as because of its key focus, in that it is actually used as the basis for building other cryptocurrency tokens to be used in other blockchain applications. With Ethereum it is possible to create a tradeable token with a fixed supply and run a central bank that can distribute the supply of this currency. This can be used to crowdfund a service or product, auction off a set number of items or crowd sell virtual shares in a blockchain based organisation. This means that companies and individuals can raise funds for a tech without requiring massive investment early on, seek out potential users and garner interest about a product or service, or use a decentralised blockchain to set up an unalterable, fully transparent democratic processes. Ethereum does have its limits, as it cannot be used to actually create other cryptocurrency coins like Ethereum itself or Bitcoin; it is instead used to create tokens that are similar to coins but are instead representations of a particular asset or utility. Tokens are tied to the coin upon which they are based, and although there are several alternatives such as Omni and Nxt, none compare to the popularity of Ethereum as a platform. The system that Ethereum uses to power all of these tokens like a great central computer is called the Ethereum Virtual Machine (EVM) that covers everything that a regular computer does, from computations to data storage. The vast machine that is running all of these transactions and services runs on a meter and requires a small fee, known as Gas from those using the service to run. The fee is incredibly small (currently around 0.00000004 Ethereum, less than 1 cent), making it possible to run a lot of complex smart contract code for long periods of time. Like Bitcoin, Ethereum nodes rely on users “mining” and receiving the gas payments (as an incentive) for running and processing user transactions and smart contracts. Unlike Bitcoin, there is not a strict amount of Ethereum that will ever be available, and the amount received from mining will depend on inflation and how the technology involves. Like Bitcoin has Satoshi's for smaller measurements of Bitcoin, Ethereum has Wei for when much smaller amounts of Ether are needed. These work just like pennies to pounds or cents to dollars, except there are 1000000000000000000 Wei per Ether. There are eleven other other sub-denominations of Ether. [caption id="attachment_8680" align="aligncenter" width="900"] The average price of Gas on the Ethereum network, Source: https://etherscan.io/chart/gasprice[/caption]

The average price of Gas on the Ethereum network, Source: https://etherscan.io/chart/gasprice[/caption]

Proof of work vs proof of stake

The process by which Bitcoin, Ethereum and most coins pace the coin creation, reward miners slowly and pace out transactions enough for the network to keep up is by millions of computers attempting to find random solutions to hashing puzzles. This is known as the ‘proof of work’ method. Named as such because it involves a lot of work on a computers behalf, resulting in that computer demonstrating its successful work with a golden nonce that produces a valid hash. The process of all these computers attempting to solve this and then verify successful solves results in a huge amount of computing power, resources and energy that is completely wasted. The amount of time and effort required for proof of work is a lot by design, which results in a lot of computing power essentially going completely to waste. There are coins that attempt to resolve this problem by having computers spend their time attempting to solve famous, unsolved mathematical puzzles. The more progress made, the more rewards are given out, unlike Bitcoin nodes which are rewarded for simply being lucky. Proof of stake is a lot more efficient than proof of work as it does not rely on solving a difficult mathematical puzzle, but instead creates new blocks in a deterministic way, based upon wealth, aka ‘stake’. The more coins owner by someone who has submitted themselves to a ‘validation pool’, similar to a network of coin miners, the louder their voice is. The idea is to not require the huge costs that must go into proof of work mining setups, and instead allow nodes run by those who are invested in the cryptocurrency a greater say in the automated decision-making process behind which blocks to next confirm to the blockchain. This method employs mechanisms seen in game theory to discourage centralised cartels from forming monopolies. [caption id="attachment_8521" align="aligncenter" width="900"] Proof of work requires a lot of time, whereas proof of stake requires authority[/caption]

Proof of work requires a lot of time, whereas proof of stake requires authority[/caption]

Smart contracts

Conventional blockchain accounts contain an address and a balance, but accounts used for smart contracts need to contain extra data to allow for the definition of the conditions that form the contract. A contract in this sense is not a signed document, but a piece of code that will output actions, release funds etc. based on defined conditions. Smart contract accounts have addresses and balances like regular accounts, but also include a state and code. The state is simply a summation of all fields and variables declared within the smart contract. This is comparable to variables and flags in most programming languages that dictate the state of various important factors, which are manipulated by conditional logic within code. The code part contains compiled byte-code that is run by Ethereum clients and nodes. When the smart contract is created, this code runs and generates its series of callable functions. Contracts can even reference and use other contracts, which alleviates some of the pressure around coding them, as any small mistake or unaccounted-for situation can lead to issues that result in the loss of funds. Where Bitcoin transactions involve sending an amount of money from one address to another, the addition of a data field in Ethereum transactions allows for multiple types of transactions to be created. The first type of transaction is a simple value transfer which works the same as Bitcoin or other cryptocurrencies. The second is a smart contract creation transaction which includes in the data field the compiled byte-code that defines and runs the smart contract. The final transaction type will make calls to existing smart contracts containing function names and parameters that can impact the state of the contract and trigger certain conditions.Applications of Ethereum

A lot of token based companies that are built on Ethereum or one of its alternatives focus on adding blockchain technology to particular sectors. At the moment, these include bringing blockchain contracting to sectors like education platforms, retirement saving, agriculture, VR and e-commerce. There are also a few speciality businesses that have sprung up around blockchain technology such as blockchain based DDOS protection services, anti-counterfeiting and small business financing. Companies who raise money in this way by creating a token which is tied to the value of Ethereum and by extension Bitcoin do so through an established contract process that has become popular. All of these companies and start-ups use blockchain as either a new way to distribute and allow payment for their services, or as a new business model entirely based centrally around the technology. There are multiple different sites dedicated to listing upcoming new Ethereum based technology launches.ICO’s

The common term for this process is known as an initial coin offering, or ICO, like an initial public offering, or IPO, but based on coins or tokens. Unlike an actual IPO, investors are not buying partial ownership of a newly public company, but the token that is representative of the asset that is central to the company’s purpose. In this way people can both invest in a company launching an ICO because they believe that it will be successful and the token will appreciate in value, just like anyone buying a stock in a company, or they can invest because they will be one of the end users of the token when the technology is up and running. Just like with an IPO, an ICO will offer tokens at a time or amount limited) reduced price than they would usually be on the open market to give a reward to early adopters. An IPO is typically an exit strategy for business owners to, via equity financing, convert their capital ownership into shares that are available publicly and whose value will fluctuate depending on market factors. An ICO differs in that it is somewhat the opposite, acting as a way for companies with limited capital to raise initial funds in a clear and easy to understand way. This fully embraces the spirit of cryptocurrencies as the dependency on traditional fundraising angels is lessened and individuals or groups with promising ideas are able to more easily go straight to market using a platform like Ethereum. The whole process also becomes a lot stricter and a lot more transparent. All early adopters and investors will have visibility on the rules of the blockchain that govern the technology, meaning fewer surprises and less opportunities for malicious or underhanded use and manipulation.CryptoKitties

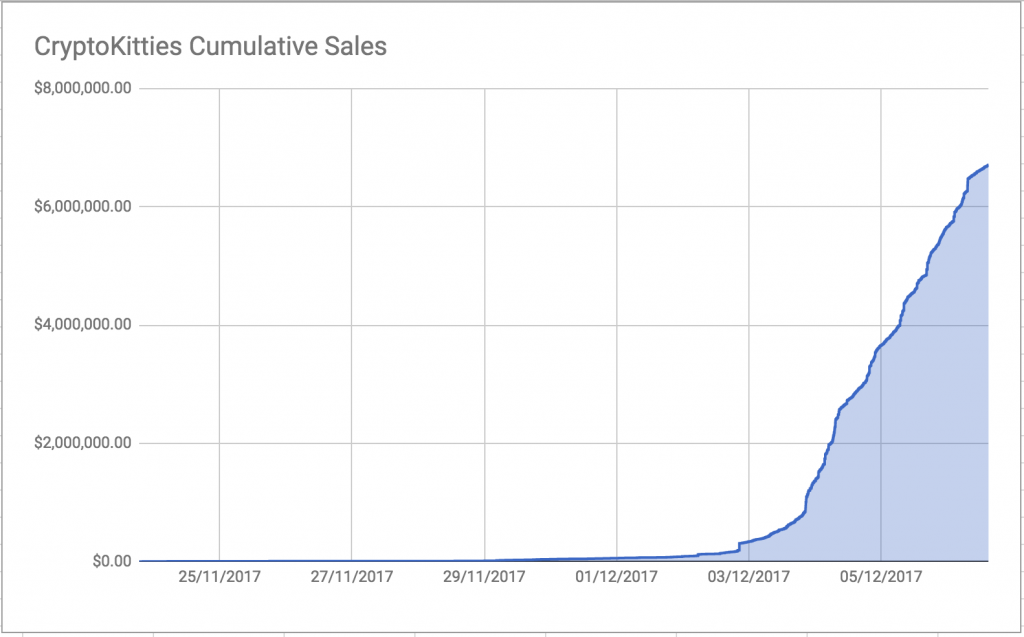

A new blockchain based digital asset trading platform has been slowing down the Ethereum network recently and exposing some slight scaling issues. The only thing that could truly push the limit of a network of online internet users is not related to stock trading, e-commerce, banking or social media, but naturally cats. Crypto Kitties is a game that teaches users about making smart contracts on the Ethereum network, and uses Ether to pay for users to own, breed and trade virtual cats. By using unique, long strings of characters to identify each cat and transfer some characteristics from the parents to the child, each cat is kept unique. Different breeds of cat have different characteristics from specific aesthetics, to varying cool-down times on breeding. This creates a collection and trading game, coupled with chance and gamification when “breeding” the cats. Currently the site has registered the equivalent of $6.7 in sales, as people have to pay to birth a kitten from two cat parents. Kittens with defining, rare or sought-after features have sold for over $100,000. The game forced a slight increase in Ether gas prices as it choked up the Ethereum network, accounting for 13.5% of all Ethereum network traffic at its peak. Ethereum currently boasts one of if not the largest development team of all cryptocurrency networks, due to its speciality as a highly customisable and workable digital smart contract platform. [caption id="attachment_8522" align="aligncenter" width="900"] CryptoKitties sales the first Nov - Dec 2017[/caption]

CryptoKitties sales the first Nov - Dec 2017[/caption]

Ripple

Ripple is a cryptocurrency with a very specific use case, that solves the common and complex problem of international funds transfers between banks. Currently, when a user needs to send money from a bank in one country to a different bank in another country, there are numerous intermediate steps that involve the money being transferred through multiple different banks or institutions before reaching its final destination. This results in transfers often taking between 2-4 days, with increased risks due to all the necessary steps, and makes it difficult for banks and users to keep track of where the money currently is or its ETA at the other end. The Ripple protocol allows the exchange of funds, as coins known as Ripples across the RippleNet, which is a huge, autonomous, decentralised network of banks, internet service providers, users, exchanges and corporations. Transfers using Ripple take between 5 and 10 seconds to complete and confirm. Instead of international transfers that often involve huge fees and inordinate amounts of time, funds are simply converted to Ripples, passed through the network charging a very small fee and converted back on the other end. A small amount of Ripple is destroyed (as a "fee") for each transaction. This stops large denial of service attacks that work by spamming transactions back and forth, as it would cost an attacker Ripples each time to do so. The current fee for a standard transaction is $0.0000732471. Comparatively, current leading international transfer companies like Transferwise can charge between 1-5% of every transaction, making Ripple potentially over 4000% more cost effective.Litecoin

Litecoin was released in 2011 by a former Google employee as a fork of the Bitcoin core code, making Litecoin almost identical to Bitcoin in most ways, but with some key areas of divergence. The main difference is that the Litecoin aims to keep blocks on the network processing every 2.5 minutes, instead of the 10 minutes that the Bitcoin network is maintained at. This makes transactions faster, but puts more strain on the network and miners to keep up to date with one another. Litecoin is often very quick to embrace new technologies and upgrades to decentralised blockchain networks, giving it an edge over slower to adapt crypto's like Bitcoin. Of the top 5 market-cap coins, Litecoin was the first to full incorporate SegWit, and is one of the first networks to begin working with the hotly anticipated off-chain Lightning Network. Litecoin also uses scrypt in its proof-of-work algorithm instead of SHA-256. Both methods are good and have their own advantages, the main benefit of using scrypt being that it is purposefully very slow and memory inefficient to decrypt a scrypt encrypted password. This is a good thing, as it is possible to run all passwords guesses from dictionary of common passwords and combinations through a SHA-256 encryptor and match them to values in a compromised database. But when it is very slow and inefficient to do so, this is not an option, making scrypt encrypted passwords just too time-consuming to try to hack.The generations of blockchain

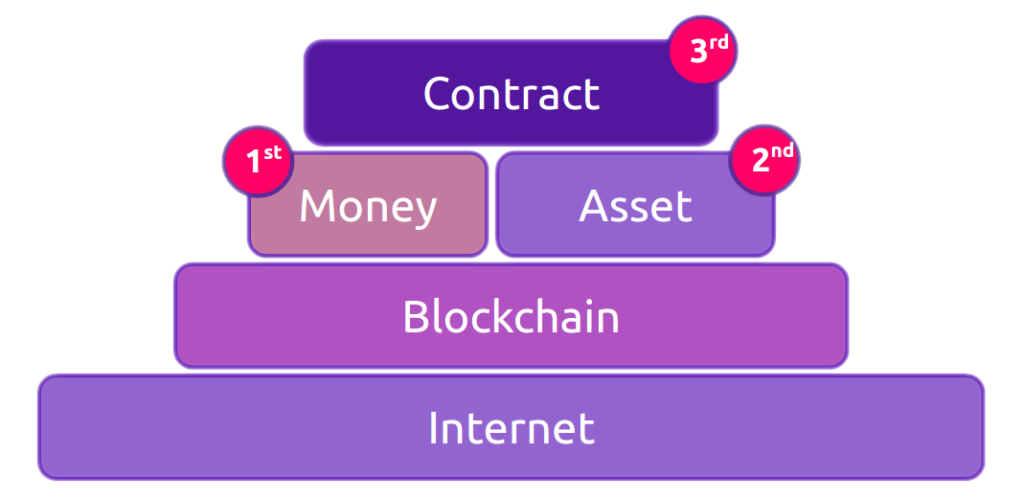

The development and application of blockchain technology has evolved since the initial 2008 Nakamoto paper that first outlined blockchain, Bitcoin and the potential for the technology. Like most forms of technology before it, from the internet, BlueRay, VHS and cassettes, to cars, planes and nuclear power, adoption can be slow and mired with doubt, especially in the instances where there are many different applications of similar technology all competing. It takes one form of a technology to rise above the rest into mainstream adoption to truly secure its place as a piece of mainstream staple technology. Within blockchain, while Bitcoin undoubtedly currently rules omnipotently from on high, it is not widely adopted, nor do the majority of the adoptees use it for its intended currency purpose. It is difficult to fully back one choice in a field that has so many evolving solutions and platforms from one year to another. With time, an application of blockchain that solves real problems, is easily accessible to the public and provides a necessary level of stability will emerge or evolve. This could be today, tomorrow, in two years or in ten.The first generation

The original intended application of blockchain was as a replacement currency that would replace conventional currencies with a decentralised, incomparable store of wealth system. The decentralisation aspect allows different parties to be able to send money to one another across the world without intervention from or reliance upon any third party, such as a bank or a payment provider. The many applications of Bitcoin, its anonymity and its guaranteed scarcity gives it its value and its uniqueness, however cryptocurrency as an application of blockchain is now known as an example of only the first generation the technology.The second generation

The success of blockchain as cryptocurrencies implored those were keen to explore further applications of the technology to do so. The next application that gained significant popularity through its useful application cases was the administration of property and assets. Ethereum is the best example of an application of asset management, providing a platform for any users to use blockchain as a way to build further secure systems for asset management. Ethereum and other second generation blockchain technologies empowered users to issue shares using blockchain, create their own token based asset ownership systems, assign voting rights to owners of shares and create smart contracts that must satisfy certain conditions in order for funds to be released. The possible applications of second generation blockchain technologies far exceed the first, due to how a system like the Ethereum virtual machine is Turing complete. The term Turing complete is used to describe technologies or languages in which any reasonable logic based can be programmed and states can be stored. This is what enables users to create all the conditional logic based application management, sharing and voting applications using the Ethereum VM. This is not referring to the code that the Ethereum platform itself is built in, but how Ethereum can become the coding platform to build and code with. One of the other most possible utilisations would be to use second generation blockchain to modernise voting systems that have not changed drastically as technology has evolved in most democratic countries, due to the fear of hacking and abuse.The third generation

The third generation of blockchain, which is the cutting edge at the moment, pertains to agreements being registered and enforced on the blockchain. Digital contracts built like this ensure that all participants keep to their side of the agreements, and that actions based on those agreements are actioned in a timely and correct order. The application of third generation technologies is another huge increase on the second generation, as it is on the first, changing more fundamental aspects of blockchain and building further on original ideas. Contracts within the third generation are not simply two users agreeing payments in exchange for services, but fully automated, machine to machine micro-payments. This involves a very futuristic sounding connection between all devices, both personal and public / private businesses, all linking with one another and making payments where necessary. This could range from your car knowing the cost of parking where you park it and relevant fees being paid automatically to paying in small amounts based on the amount of an activity participated in.

The machine economy

The machine economy, or machine to machine payments, is the most powerful modern utilisation of blockchain tech and is already creeping into some of the leading tech companies of today. This is particularly evident when looking at two different aspects of Amazon's business, one hugely successful, one only beginning to emerge. Amazon Web Services (AWS) is a massively popular web server hosting platform that powers some of the biggest online technologies and websites in the world, including Unilever, General Electric and Netflix. AWS is popular because like Amazon's e-commerce site, all solutions are offered under one umbrella, and Amazon keeps adding more and more. Typically, for a complex website, a great many different services would be pooled from different providers and services to create a complex site with all of the necessary functionality. However Amazon succeeded with AWS in no small part because they offered all, or an increasing number of these services in one place. Another key aspect of AWS' rise in popularity comes from the resource driven payment models. Since the dawn of the web, hosting your own server involved selecting from a set of tiered packages that offered a key set of features, space and memory. If your site grew too large, you had to upgrade to the next tier and if you overestimated your sites popularity, you were left overpaying for a server tier that you did not require. While AWS still has a tiered structure (although it has 20+ base tiers!), the exact costs within these tiers is subject to usage. This means that setting up a site on AWS offers several financial and technological efficiencies, not overspending when a site isn't busy, but scaling up server resources and increasing spending only during peak times or seasons. This model, based on usage, scalability and all services united under one umbrella is central to the idea of the machine economy. It would be quite a technological and societal leap for all of the services that people use, be that online subscriptions, travel costs or online purchases to all be connected in this way and subject to pricing based on actual usage, with payments exiting and entering accounts regularly in micro-amounts. The other example involving Amazon that involves somewhat less tried and tested technology was demonstrated in a promotional video in late 2016. This technology involved buying items in a typical grocery shop, without the need to queue, use a checkout or pay in any active way. The technologies used in this example shop are based on machine learning, computer vision algorithms and artificial intelligence. These combined allow sensors within the shop to track individual users and be aware of items that are picked up, put back, and taken out of the store. When items are taken out of the store, they are paid for automatically via the users Amazon account. At the moment this idea is centred around a single store, belonging to a single company, but it gives a good example of a possible application of the machine to machine economy in practice.Getting involved with exchanges and wallets

Starting out with Bitcoin can be a very daunting experience, with so much to learn, the high volatility and the risk involved when it comes to financial matters. There are several exchanges that exist to make getting started with Bitcoin easier by offering simplified, familiar front-end user interfaces to sending money around to different addresses. Exchanges like this are great for getting started, but should only be used initially or to purchase funds. Most exchange sites like this will add extra fees on to transactions. These are not related to Bitcoin or blockchain, but are just the way that the sites make money and invest in providing an easy to use UI.Coinbase

The most popular of these exchanges is Coinbase. Coinbase, like most other exchanges is however just a website, and is thus subject to outages during periods of heavy use just like any other site. Bearing in mind Bitcoins infancy, it can also be difficult to use GBP for purchases on some exchanges, but Coinbase does offer the ability to purchase using GBP. Coinbase also has a sister site called Gdax, which is a little less forgiving with its interface, not best suited for very new users and still relies upon funds from a Coinbase account. Gdax also allows for more complicated LIMIT and STOP based transactions, which can be set to run when prices reach certain criteria. If you intend to purchase some Bitcoin, you can sign up to Coinbase using this link and receive £7 in Bitcoin for free (that offsets most of the fees!). Other exchanges like Bisq operate as a decentralised, open-source peer to peer exchange. Bisq has the advantage of not being run by a centralised exchange, so the middle men are removed, dramatically lowering payment fees and increasing privacy. The only thing that exists between buyers and sellers on Bisq is the software. LocalBitcoins is similar, but is a site that allows users to set the price at which they want to buy and sell Bitcoin for other cryptocurrencies or conventional currencies. These solutions are a bit less friendly for newcomers to Bitcoin, but they do avoid fees that can become quite large when purchasing extensive amounts of Bitcoin. A full list of trusted exchanges is available on the Bitcoin.org website.Moving on from exchanges to wallets

Once you have your feet wet, or if you would rather skip putting any money down for now and explore the technology, you need to start looking at better ways (than online exchanges) to hold and secure your coins. Remember that at no point is anything signifying a coin being stored here, but the private keys to access addresses on the blockchain that have a history of coins being sent to that address, demonstrating a balance via a history of inputs and outputs. Hardware wallets are among the most secure available choices. These are bespoke, security-hardened devices that store address information on a physical device that is trusted to generate wallet keys and to sign transactions. This means that private never leave the device, with only private key signed transactions leaving the device to make transactions. The obvious drawbacks being that a physical object is easily lost or damaged, somewhat coming full circle to the obvious issues and drawbacks of storing a large amount of physical cash. A multisignature wallet is one that requires multiple private keys to move Bitcoins instead of one single key. The advantage here is that the multiple required keys can be spread across multiple machines in multiple locations, dramatically removing the likelihood that a hacker or malware will gain access to all required devices. These wallets usually operate using an m-of-n-type principal, which means that only m of a possible n created private keys are required to make a transaction. An example would be that a private key exists on a desktop PC, a laptop and a phone and two of the three keys are required to make a transaction. This type of wallet is arguably the most secure available, and is freely available for download online. Some of the best available wallets are Electrum, Armory, Copay and Coinbase (which has a multisig “vault” which works in the same way). A hot wallet is the name for a typical single private key wallet and is the most common type of wallet. For small amounts of coin or few regular transactions, a hot wallet will easily suffice. But for larger amounts of continual use, they are not ideal, due to one security breach or malware infection can result in the total loss of all coins associated with those addresses. Cold storage wallets are unique in the way that they go about adding another layer of security. Cold storage involves keeping all wallet information online, and passing transaction details to watch-only wallets that relay information to the cold storage wallet on a device. With proper usage, they are comparable to hardware wallets as they protect from online scams and viruses by being completely disconnected. Custodial wallets are those that sit on an online exchange, broker or third party. A general golden rule of Bitcoin is that if you do not have direct access to the private keys (like you don’t on an exchange), then you don’t actually own the assets. This is designed to highlight the lack of control you have, and the lack of recourse the third party has if security is breached and coins are moved elsewhere.Future challenges and risks for crypto and Bitcoin

All cryptocurrencies have their unique advantages, and all have their challenges to overcome. Bitcoin being the first cryptocurrency platform has benefits and disadvantages. Plenty of similar cryptocurrencies have been created over the past few years that solve significant gaps in Bitcoins application of the blockchain technology, but each is not without its own shortcomings. The main disadvantage for Bitcoin is that it was the first, so is subject to a lot of scrutiny and competition from newer projects. However it does have the advantage of having by far the largest market cap, current worth and user adoption, meaning that there are a lot of developers working to push Bitcoin forward and improve upon its weak areas. One of the main shortcomings of Bitcoin as it exists at the moment is the block size limit. The size of a block that is added to the chain can only be a maximum of 1 megabyte (1MB) in size at the moment. This limits the rate at which simple transactions can be made to the equivalent maximum of between 7 and 10 transactions a second, with any complex transactions or smart contracts taking up more space. Around 2000 transactions in total will fit inside a 1MB block, limiting Bitcoins current daily transaction cap to around 360,000 transactions a day. To scale that up to something like VISA’s average transaction rate of 2000 a second (millions a day), clearly some improvements still need to be made. [caption id="attachment_8917" align="aligncenter" width="900"] Source: Dan Gribben, https://www.dangribben.com[/caption]

Source: Dan Gribben, https://www.dangribben.com[/caption]

Legality

Bitcoins involvement in anonymous illegal activities has been a topic of discussion, especially in the early days when websites like the Silk Road were still running. The Silk Road operated as an online marketplace for illegal drug buying and selling, counterfeit items, weapons and even contract based criminal activities and used Bitcoin as a primary payment method, giving users the complete anonymity their purchases relied upon. However blockchain technology does not provide an infallible platform upon which criminals can flourish. The same traps, investigatory methods and police / FBI practices that take down criminals still allow people to slip up, get arrested and get punished. People are still human beyond their Bitcoin transactions. They still spend huge amounts of time online and sites on the web track every movement and site visited more and more every day. It was a typical mix of slip-ups, arrogance and ignorance that lead to the FBI arrest of the Silk Road founder Ross William Ulbricht in a public library on a Tuesday afternoon. Like the fight against online piracy, the fight against illegal commerce online is won by going after the business and services that run, instead of spending far more time and money attempting to track down and target individual users or by outright banning the associated technology platforms.Governments

It would not be a stretch to say that recently there has been a surge in support for alternative political norms, most evidently with movements in the USA and in the UK. Some of the ideals behind these movements tie in quite closely with the core ideas behind Bitcoin and cryptocurrencies. The notion of an apodictic alternative currency is quite a libertarian concept that aligns quite well the popular apathetic stance concerning traditional, large-scale banking institutions. Cryptocurrencies begin to offer those who may hold a comparable opinion an avenue to discover possible alternatives to conventional financial structure. A designed, decentralised payment system that does not rely on any bank, government of governing body of any kid is an affront to these systems of power, who are already in some cases seeking to control and subvert them as best as possible. Not to don a tinfoil hat, but when banking experts and leaders (who make billions off of the system that is in place) condemn something like Bitcoin as a scam or a bubble, is it not in their own interest to do so? All of these ideas help to fuel Bitcoins rise in popularity and in price, as people are shown a practical and effective method to disrupt and to create change. Which make the rise of cryptocurrencies tantamount to some of the other largest, most successful grassroots campaigns in recent history. There are precursor projects to decentralised blockchain technology that promote anonymity and attempt to take power back into the hands of a mass of users so large, that is effectively incorruptible by any one individual. The Tor project is possibly the best application of such an ethos in a technology. Governments, regulators and ISP's increasingly go through great lengths to censor content and dictate what users should have access to online. Projects like Tor demonstrate that although governments have methods to enforce rules on existing technology, no monopoly can be kept on technology as long as there are those that are willing to build solutions. The Tor project is a web browser tunnel network that circumvents all ISP based restrictions and provides complete anonymity to anyone browsing online, requiring only a regular internet connection. Cryptocurrencies operate in the same vein, born of a Libertarian style dissatisfaction in current methods or levels of censorship and subject to the same misuses for illegal purposes. But like Tor, cryptocurrencies are not something that any government can ever have absolute power over, as via decentralisation, the power is very literally put in the hands of the people.Technology

The tech behind all cryptocurrencies is still very new, and changing very frequently. Community driven development involves voting and discussions, sometimes even with unresolvable disagreements arising. When a clear change in protocol is required and made that effects block structure or parameters for accepted transactions / blocks, that is called a hardfork. When such a change is made, previously invalid blocks and transactions are made valid, which forces all users to upgrade. When differences in technical direction arise, sometimes development splits into another chain, and another coin that must have a slightly different name is created. Theoretically both coins can exist together and progress, but eventually one always appears as a winner, usually because it has a better solution to a common problem. The most recent fork of Bitcoin is a currency that is now known as BCash, or “Bitcoin Cash”. The key reason for this fork argued by proponents was the increase in a 1 megabyte block size to 8 megabytes, reducing or removing the backlog of transactions by allowing for more transactions to be confirmed per block. While this seems like a simple solution, it is now widely viewed as a poorly thought out temporary fix that creates more problems than it solves. Eventually 8MB will not be sufficient, and another fork will be required, meaning more changes and more inconsistency. BCash also throws out some of the most recent agreed upon changes to Bitcoin that improve transaction size efficiency, which is an actual attempt at a long-term solution to the block size problem. With a greater block size, more computing power is required to run a mining machine. This prices out some of the smaller miners which begins to decentralise BCash and put the power and control in the hands of larger organisations who simply manipulate price for profit. There have already been several controversies and accusations concerning BCash regarding insider trading and orchestrated attempts by large China based groups to control the currency. The vast majority of the current mining nodes are on the same Chinese network, and the currency is somewhat controlled and influenced by an early Bitcoin investor called Roger Ver.Hard forks

Although Bitcoin Cash is slowly dying out now, it does not mean that Bitcoin and other currencies will fork again, and more successful versions could actually emerge. This is not a huge risk for cryptocurrencies in general, as evolution and improvement is beneficial for everyone, but anyone looking at something like Bitcoin purely as an investment must be well informed about all of these factors. Arguably, other coins already pose more of a thread to Bitcoin than any fork. The technical brilliance of coins like Ethereum or Ripple have so much potential that is being realised as more and more applications are building up around them. Ether powers almost all ICO’s and blockchain related fund-raising applications in existence, making Ethereum a prime candidate to overtake Bitcoin should it falter in any serious manner. RippleNet is a huge network that connects banks, providers, users, exchanges and corporations that allows the sending of funds globally. The speed and scalability of Ripple make it incredibly powerful as it looks to make the world a smaller place and remove the archaic methods involved in sending money to those in other countries.Adoption

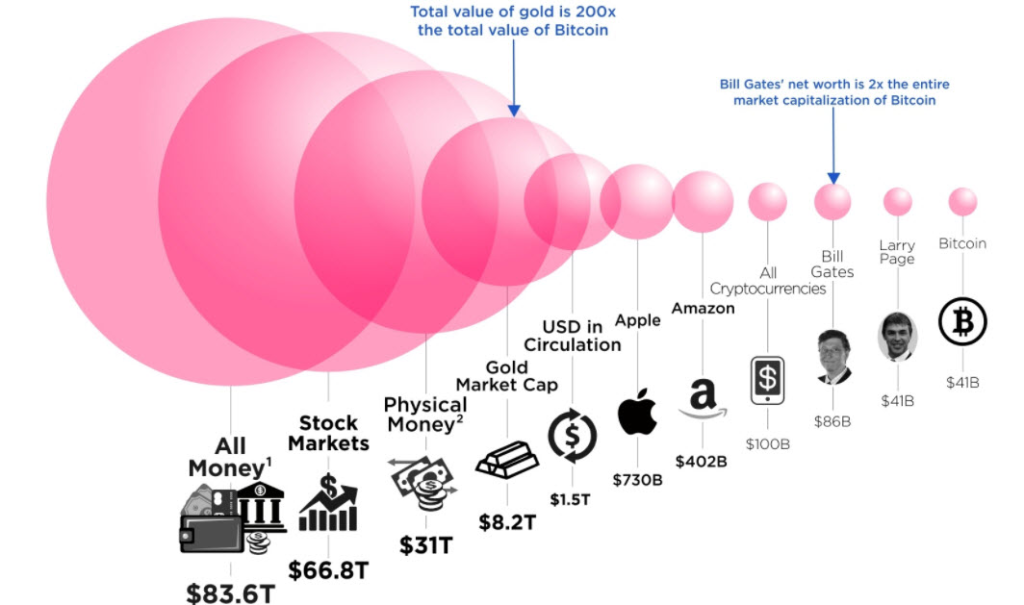

“Bitcoin is a scam, a Ponzi scheme designed to cheat people out of money”. Most people know someone whom has voiced this opinion at some point. While everyone is able to have an opinion regarding the future and sensibility regarding Bitcoin and cryptocurrency, it remains factually and intellectually dishonest and either deceitful or ignorant to describe Bitcoin as a scam. Most people who do so simply do not understand the technology. Many people have witnessed real online financial scams, especially in the early days of the internet, so can be overly sceptical when something like Bitcoin rises in value as quickly as it has done. The other opinion that a lot of people are quick to offer is the idea that Bitcoin is currently in a “bubble”. A bubble in a financial sense refers to a situation in which the price of an asset far exceeds its fundamental value, with prices changing and forming based on mere speculation regarding value and profit. Bubbles involve adoption of a technology or service, slow price growth in the early phases followed by a boom which continues rapidly upwards up to a point where smart investors cash out, and everyone else begins to panic and attempt to abandon their investments as quickly as they can too. Definitely very comparable to Bitcoins history over the past few years.Nevertheless, this is not a model for predicting bubbles, but more a retrospective of what happens when bubbles burst. There are far more examples of technologies following this process and the price stabilising or even reducing a little before stabilising without the characteristic and dramatic ‘pop’ of a bubble. Bitcoin is also slightly different from all previous examples of Bubbles, as it is itself a currency and not a commodity or service. Its rise has been driven by users and technologists, not just by speculating traders. To claim that Bitcoin is in a bubble and will burst is to guess. Until the measurable success or failure of adoption of something like Bitcoin by the mainstream public is possible, there is really no way to tell. The US bursting of the housing bubble of 2008 - 2009 caused the worlds twelve largest financial institutions to lose half of their value overnight, demonstrating how bubbles cannot be accurately predicted. [caption id="attachment_8894" align="aligncenter" width="900"]“Bitcoin is in a bubble, and it has to burst soon”

Bitcoin is still not comparable to other large, disruptive or typical financial services or commodities. It's easy to see Bitcoins rapid growth, but to suggest that it has exceeded its real value (aka in a bubble) does not seem obvious when compared. Source: https://blog.evercoin.com[/caption]

Mainstream user adoption is increasing from around 0.1%, with countries like Japan and South Korea leading the way, but it still very difficult for the majority of people to understand and appreciate. Most people will have one gripe or another regarding a bank, a banking caused financial crisis, government bailouts or positions when it comes to large financial institutions, but lack the ability, time or knowledge as to what they can really do about it. Who can get by without a bank account? Even if the increasingly untrusted banking monopolies were gone tomorrow, how would people get by? Changing perception around these things takes a lot of time and trust building on the side of users, small business owners and large international merchants. And it could easily be argued that no cryptocurrency has yet demonstrated itself to be worthy of having such an argument made for it.

Bitcoin is also unforgiving. There is no branch to visit or someone on the end of the phone (not to say that customer facing services will not develop around cryptocurrencies). If a cryptocurrency transfer is messed up by a user in some way, there’s no error message, retrieval of funds or bank to fall back on (yet), the mistake is the users to own. Freedom from banking institutions also comes with its degree of responsibility and difficulty. For a generation growing up online, the answers are there, but for a lot of people the trust in something they see as a scam or a bubble just doesn't exist yet.

True success for Bitcoin involves far more people owning and spending coins, of which there is a limited supply. 21 million coins seems like a lot initially, but as mainstream adoption grows, scarcity and fear of missing out drive up demand and prices. While there are still some users who hold vast amounts of Bitcoin, the distribution of wealth is improving as more and more people become involved and purchase coins.

Bitcoin is still not comparable to other large, disruptive or typical financial services or commodities. It's easy to see Bitcoins rapid growth, but to suggest that it has exceeded its real value (aka in a bubble) does not seem obvious when compared. Source: https://blog.evercoin.com[/caption]

Mainstream user adoption is increasing from around 0.1%, with countries like Japan and South Korea leading the way, but it still very difficult for the majority of people to understand and appreciate. Most people will have one gripe or another regarding a bank, a banking caused financial crisis, government bailouts or positions when it comes to large financial institutions, but lack the ability, time or knowledge as to what they can really do about it. Who can get by without a bank account? Even if the increasingly untrusted banking monopolies were gone tomorrow, how would people get by? Changing perception around these things takes a lot of time and trust building on the side of users, small business owners and large international merchants. And it could easily be argued that no cryptocurrency has yet demonstrated itself to be worthy of having such an argument made for it.

Bitcoin is also unforgiving. There is no branch to visit or someone on the end of the phone (not to say that customer facing services will not develop around cryptocurrencies). If a cryptocurrency transfer is messed up by a user in some way, there’s no error message, retrieval of funds or bank to fall back on (yet), the mistake is the users to own. Freedom from banking institutions also comes with its degree of responsibility and difficulty. For a generation growing up online, the answers are there, but for a lot of people the trust in something they see as a scam or a bubble just doesn't exist yet.

True success for Bitcoin involves far more people owning and spending coins, of which there is a limited supply. 21 million coins seems like a lot initially, but as mainstream adoption grows, scarcity and fear of missing out drive up demand and prices. While there are still some users who hold vast amounts of Bitcoin, the distribution of wealth is improving as more and more people become involved and purchase coins.